Well the first month in my 1st Quarter spending freeze is over and I thought I would come here and just share some of my highs and my lows!

I knew that going on this budget would be difficult for me. I have an impulse problem, I shared about that. And specifically I seem to be even more impulsive when I am struggling (angry, sad, grumpy etc…) Well January was a TOUGH month. From computer problems that extended on for weeks and made me VERY crabby, to general stresses with work and home life – I was over January by about the 7th.

I called my best friend and said I just wanted to buy something, anything to feel better. A true indication that there is a problem if I feel like that is the only thing that will cure my woes.

For the most part I was determined. I wanted to be able to remain strong. I wanted to break old, bad habits and create better, more healthy new ones. I can’t say that I am totally there yet but I feel like I am on my way.

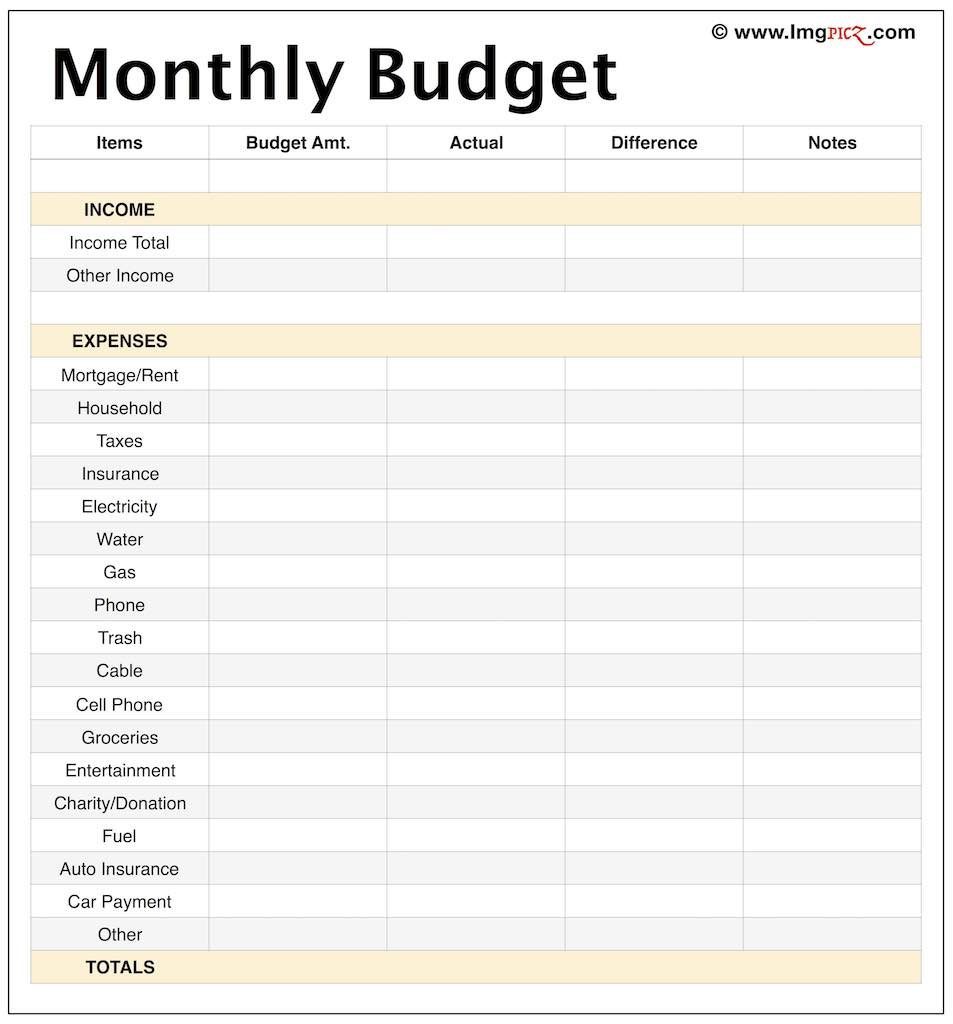

I shared earlier this month that I started an Excel spreadsheet to track all of our spending. I wanted to be able to look at the month and see where we had spent our money and on what. I worked on finalizing that this morning and it was very interesting.

We spend a LOT on food. More than I realized. When we had met with our financial adviser and he had asked us to estimate that number I told him at least half the amount we apparently actually spend. And that doesn’t include a cost for household supplies. Now some of my expenditures in January won’t need to be repeated in February.

I had a 10% off coupon from Walmart to order online with them by the 15th. It was good up to $20 off – which means I needed to spend $200 on items to get the full 10% off discount value. To do this I ordered 3 bulk packs of toilet paper, kleenex, several jars of spaghetti sauce and noodles and cereal. All things we use pretty regularly and many items that will last us well into February and maybe even March.

It will be interesting to see how that number fluctuates in the months going forward. But doing this exercise opened my eyes to what we really spend and helps me plan going forward.

While there were many “wins” this month, I didn’t end this month perfectly either. There were lots of conversations about spending. More than once I told the kids no when they asked if they could purchase a movie or a mod on their Kindle. I did say that we could talk to Dominic about it and see if it was something he agreed to. Interestingly the topic didn’t come up again…hmmm.

There were some purchases that I made that absolutely would be considered “discretionary” but in the grand scheme were minimal and necessary (justify much?!) Karlena doesn’t fuss with her hair at all. She rarely lets me comb it, so when she mentioned wanting to find something that would dry and maybe style her hair a little I perked up. When I just blow dry her hair it becomes a tangled, huge mess. Most days she was going to school with pretty wet hair.

I had seen a Revlon Hairdryer/Brush combo advertised online and it had a bunch of good reviews. It went on sale from $60 to $43 and I had $14 in Amazon free credit points built up…so I bought it. It is AMAZING. I know we could have waited until after April to purchase this, but it has worked so well, and so quickly…it was worth every cent.

I also bought myself a new $12 belt. Again I didn’t NEED it right this moment – but I saw it and bought it. That was my biggest fail this month I suppose. I justified it again because I told Dominic, it was cheap and my old one is wearing out. But the reality was I didn’t need it right then and could have waited until my older one really bit the bullet. I see it for what it is. I needed to get something and this was an easy out for me.

I did also go out to eat twice, once with some girlfriends and once with a larger group of girlfriends. Total those meals cost me $34. And our family went out to eat for fun one night at Perkins. For a family of 5 we spent $69. The food was ok but it was a reminder to me why we don’t often eat out. I can make much more food (and better IMO) for much cheaper.

Some unexpected but needed expenses came up when I had to buy new shoes for Karlena and new snow boots for Elijah. I also decided (with Dominic’s full approval) to shop ahead and purchased a new larger winter coat for Elijah for next fall/winter. He will need the larger size and this one was on 60% off clearance so it made sense to buy it now instead of at a more expensive cost later this year.

Again I am tracking on my spreadsheet on a separate form to record all clothing expenses so that I can see how much that adds up to over the course of a year as well.

I am sure that all of this spending and budget talk is boring but it is good practice for me to not only spend some time looking back at my month, the wins and the losses, as well as making a record for later. I don’t want this time to be one of just suffering through 90 days and then going right back to my bad habits.

I have said it before, I need to develop better habits and response mechanisms. Maybe I will walk away from this experience with a budget that helps me stay on track. Maybe I will be able to continue to say no when the purchase isn’t a need right now. Maybe this will develop in me that pause that I have been lacking.

I was talking with a friend last night and said that I had gotten into such a habit of impulse that I would just buy things and ended up not loving them. Now my closet has things in it I force myself to wear not because I love them or the way I look but because I don’t want the cost the be wasted. If nothing else, this will hopefully help me to be more considerate of the whys of my purchases.

So while January was a bear in many ways it was also eye opening and valuable and I am grateful that I am going through this.

I was thinking of doing a no-spend Feb. I had been good, I did FPU 2 years ago and started using the EveryDollar app. It was definitely eye opening, especially the grocery/restaurant categories. I fell off the wagon this fall, basically I was in denial and hiding since the flooded basement messed us up so much, then the dental expenses. But now I need to get it back in line. Thanks for the inspiration.